For greater than a decade, Apple was the inventory market’s undisputed king. It first overtook Exxon Mobil because the world’s most useful public firm in 2011 and held the title nearly with out interruption.

However a switch of energy has begun.

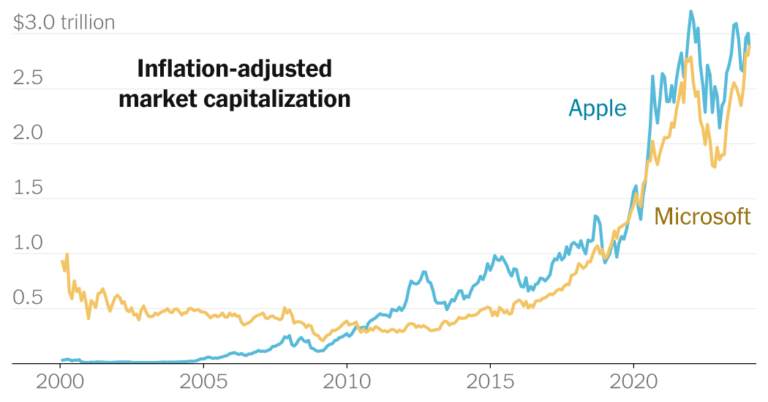

On Friday, Microsoft surpassed Apple, claiming the crown after its market worth surged by greater than $1 trillion over the previous 12 months. Microsoft completed the day at $2.89 trillion, greater than Apple’s $2.87 trillion, in accordance to Bloomberg.

The change is a part of a reordering of the inventory market that was set in movement by the arrival of generative synthetic intelligence. The expertise, which might reply questions, create photos and write code, has been heralded for its potential to disrupt companies and create trillions of {dollars} in financial worth.

When Apple changed Exxon, it ushered in an period of tech supremacy. The values of Apple, Amazon, Fb, Microsoft and Google dwarfed former market leaders like Walmart, JPMorgan Chase and Normal Motors.

The tech business nonetheless dominates the highest of the checklist, however the corporations with essentially the most momentum have put generative A.I. on the forefront of their future enterprise plans. The mixed worth of Microsoft, Nvidia and Alphabet, Google’s mum or dad firm, elevated by $2.5 trillion final 12 months. Their performances outshined Apple, which posted a smaller share value enhance in 2023.

“It merely comes down to gen A.I.,” mentioned Brad Reback, an analyst on the funding financial institution Stifel. Generative A.I. will have an effect on all of Microsoft’s companies, together with its largest, he mentioned, whereas “Apple doesn’t have a lot of an A.I. story but.”

Microsoft and Apple declined to remark.

Microsoft has not led a expertise transition for the reason that private computing period, when its Home windows working system dominated gross sales. It was late to the web, cell phone and social media.

When Satya Nadella grew to become Microsoft’s chief government in 2014, the corporate was floundering. He refocused it on the rising cloud computing enterprise, turning it into a powerful challenger to Amazon, the pioneer within the area. Then Mr. Nadella pushed the corporate ahead once more, making an aggressive wager on generative A.I.

In 2019, Mr. Nadella made Microsoft’s first of a number of investments in OpenAI, the start-up that might construct the A.I.-powered ChatGPT chatbot. In the long run of the summer time of 2022, he was impressed by a preview of OpenAI’s underlying expertise, generally known as GPT-4, and quickly started prodding Microsoft to add generative A.I. to its merchandise at what he known as a “frantic tempo.”

He began with including a chatbot to the Bing search engine, however then started pushing A.I. into the Home windows working system and productive functions like Excel and Outlook, and providing OpenAI’s techniques to clients of Azure, Microsoft’s flagship cloud computing product.

The income has solely simply began to present up in Microsoft’s monetary outcomes. Generative A.I. accounted for about three share factors of development to Azure within the three months that led to September, and the $30-a-month providing inside Microsoft’s productiveness software program started a common launch solely in November.

(The New York Instances has sued OpenAI and Microsoft, accusing them of copyright infringement.)

This isn’t the primary time that Microsoft has pulled forward of Apple in recent times. It did so in 2018, as its cloud-computing enterprise started to flourish, and in 2021, when the pandemic disrupted Apple’s iPhone operations. However this variation could possibly be extra indicative of a elementary shift within the tech business.

“The query is: Who has the higher mouse entice to go to the following degree of $3.5 trillion?” mentioned Dan Morgan, portfolio supervisor and analyst at Synovus Belief, a financial institution within the Southeast. “You may make the case that Microsoft is within the higher place. Apple has been struggling for the following huge factor.”

The iPhone, which debuted in 2007, catapulted Apple to the highest of the inventory market. Between 2009 and 2015, the corporate went from promoting 20 million iPhones a 12 months to greater than 200 million.

When gadget gross sales slowed in recent times, Tim Cook dinner, Apple’s chief government, shifted the corporate’s focus from promoting extra iPhones to promoting folks extra apps and companies on their current iPhones. The technique helped Apple’s annual income soar to $383 billion, a virtually fourfold enhance from the top of 2011, the 12 months that Steve Jobs, Apple’s co-founder, died.

Mr. Cook dinner’s technique has proven indicators of fatigue. The iPhone, which accounts for greater than half of Apple’s income, has grow to be recognized extra for its incremental enhancements annually than its noteworthy improvements. Purchases of iPads and Macs have declined. And the gross sales development of its companies reminiscent of Apple Music are slowing.

Final 12 months, the corporate’s gross sales fell for 4 consecutive quarters. However shares of Apple nonetheless rose round 50 % final 12 months, and buyers lifted its market worth to practically $Three trillion due to their perception that demand for the iPhone would proceed.

Wall Road analysts have predicted that this 12 months’s iPhone gross sales shall be weak. The corporate is going through challenges in China, the place Huawei has launched a brand new cellphone and the federal government is limiting using overseas smartphones.

Whereas Microsoft and others have been constructing new generative A.I. companies, Apple has been absent from the dialog. Throughout a name with analysts final 12 months, Mr. Cook dinner mentioned Apple had work “happening” related to A.I., however he declined to elaborate.

Final 12 months, Apple engineers have been testing a big language mannequin, which might energy a chatbot, The Instances reported. The corporate has additionally held discussions with publishers about buying materials to practice generative A.I. techniques. However it has but to launch something publicly.

“Apple wants to take word that if they need to keep their spot as one of the modern tech corporations, they’ve to get behind A.I. in an enormous approach,” mentioned Gene Munster, managing accomplice at Deepwater Asset Administration.

Apple has been targeted on the discharge of an augmented actuality headset, the Imaginative and prescient Professional. The gadget, which can ship Feb. 2, is the primary main new product class that the corporate has launched for the reason that Apple Watch in 2014. Analysts venture Apple will promote fewer than half one million items.