Disclaimer: Opinions expressed beneath belong solely to the writer and don’t represent monetary recommendation. On the time of writing the writer had no holdings in cryptocurrencies.

The day long-awaited by crypto followers is lastly right here. The American Securities and Trade Fee lastly permitted the primary spot Bitcoin ETFs for buying and selling within the US.

If you happen to’re unfamiliar with the phrases, ETF (exchange-traded fund) is a fund that makes funding choices by itself, often holding a various combine of completely different belongings, and all you do is purchase a share in it as when you bought a share in an organization.

From right this moment, Bitcoin is usually a half of its portfolio, with 11 funds explicitly devoted to BTC permitted for launch right this moment.

Why it’s such an enormous deal

The principle consequence is that somebody can now pour trillions of {dollars} invested in America into the cryptocurrency.

Till now, when you wished to spend money on BTC, you had to purchase it, which usually concerned establishing an account on one of the exchanges (like Coinbase, Binance or the ill-fated FTX), making a digital pockets, transferring and changing fiat and buying and selling the coin there.

This course of meant you had to put some effort and curiosity into the endeavour, and — as exhibited by FTX’s spectacular implosion in 2022 — concerned insignificant dangers.

From right this moment on, nonetheless, Individuals can spend money on Bitcoin just by shopping for shares in a single of the traded funds that maintain it. Many may not bear in mind of the precise composition of an ETF asset sheet and nonetheless have a portion of their cash positioned into the main cryptocurrency.

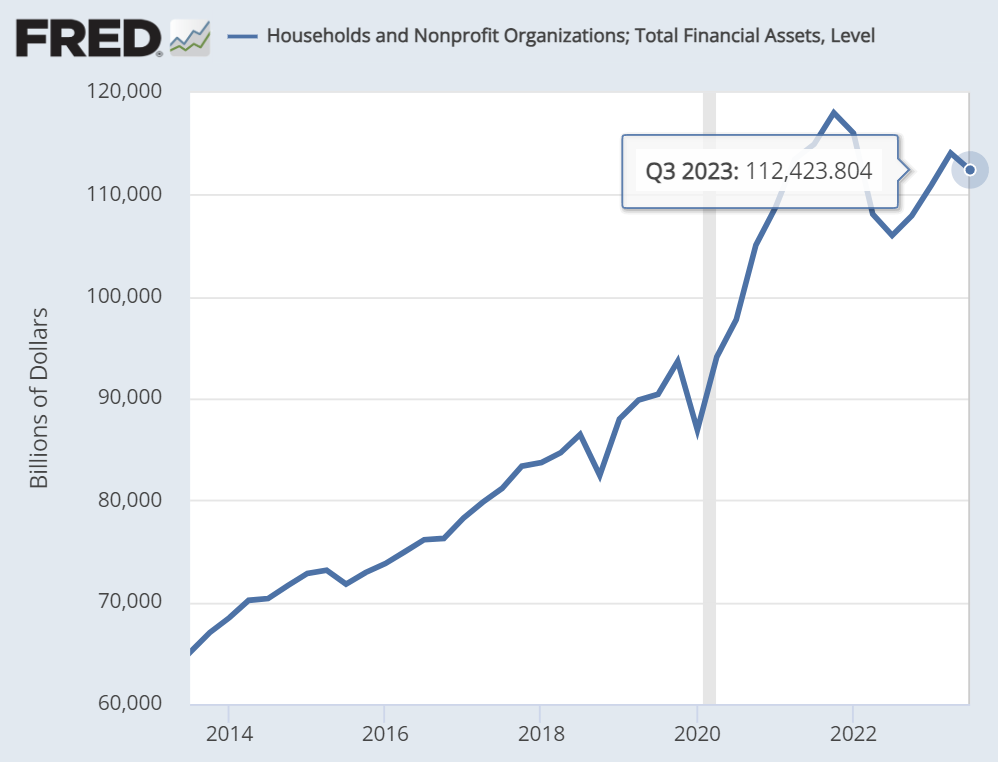

It is a huge deal for the reason that newest figures put American family holdings of monetary belongings at over US$112 trillion, together with over US$43 trillion in shares. Trade-traded funds hit a document milestone in December, surpassing a mixed US$eight trillion in belongings beneath administration.

American households held $112.Four trillion in monetary belongings as of Q3 of 2023 / Picture Credit score: Federal Reserve Financial institution of St. Louis

In the meantime, even after final yr’s vital positive factors, Bitcoin’s complete market capitalisation remains to be solely round US$900 billion.

As you may see, then, many crypto optimists expect that even a tiny chunk of this large funding pie might set off a fast appreciation of BTC, elevating it to — or past — the document highs recorded in 2021, when the coin’s value briefly hit over US$65,000.

To the Moon…

That is why Bitcoin appears so well-positioned to go up in worth.

Sure, Bitcoin ETFs are nothing new globally, and even the US has permitted some funds that used Bitcoin futures (an instrument that tracks the long run value of the coin), permitting folks to commerce in BTC-linked belongings for the previous two years.

However the sheer scale of the American market, coupled now with the permission for funds to maintain Bitcoin immediately, has the potential to unlock a flood of cash that would revive the growth of 2021.

Because the buying and selling on the primary day attracts shut, the amount throughout all 11 permitted funds has hit US$4.6 billion, already proving excessive demand.

That is undoubtedly ground-breaking, there was little question demand could be robust for these ETFs, however the numbers throughout the board are spectacular.

Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, Bloomberg through Yahoo

Naked numbers, then, and market circumstances appear to be on Bitcoin’s aspect. Nevertheless, not all is so rosy.

…and again to Earth

First of all, the influence on the worth of Bitcoin is, as ever, going to rely on the anticipated future value of the coin. The fundamental guidelines of investing don’t disappear just because more cash may have access to a selected asset.

Secondly, Bitcoin’s elementary flaws are nonetheless there. Thus far, the token has no actual utility and is held purely as a speculative asset. There’s no knowledge — past solely technical indicators — that you can use to predict future value strikes fairly.

Conventional currencies sometimes depend on broad financial info, together with GDP progress, commerce, debt, inflation and so forth, to decide the worth of every foreign money vs. one other one. However no such statistics exist for BTC as a result of it’s not used for any actual function outdoors buying and selling.

Lastly, it has already appreciated fairly enormously over 2023, and deal of this progress occurred since October after the SEC misplaced its authorized battle with Grayscale Investments, which sued the fee after being refused a conversion of its present belief right into a spot-traded ETF.

All year long, even earlier than the ultimate ruling, different corporations have filed their functions, together with the heavyweights from BlackRock or Constancy.

In different phrases, 2023 has been a yr of anticipation that has already drawn appreciable funding, elevating BTC value by over 150 per cent to round US$45,000.

Paradoxically, one of the best ways to earn money on Bitcoin ETFs may have been earlier than they launched.

This could clarify the coin’s timid response to the funds’ launch, with a short soar following the Wednesday announcement and no significant motion since.

As of now, it remains to be about 50% off its 2021 peak of US$65,000. However is it sufficient of an upside to justify the danger that it may simply as effectively go down by as a lot? In spite of everything, it was only a yr in the past when it was nonetheless beneath US$20,000.

There are these, of course, who imagine it may attain US$100,000 or extra, however the foundation for this optimism is, at finest, a notion that individuals will as soon as once more go loopy for crypto as they did 2-Three years in the past.

Since then, nonetheless, many have been badly burnt, and following the next implosion of the NTF market, there’s been no new promise of utility for any cryptocurrency.

With the approval for publicly traded Bitcoin ETFs, investing in crypto may have develop into safer and extra regulated, however the elementary dangers stay the identical.