To advertise sustainable power practices, Pantas Software program Sdn Bhd (a carbon administration and ESG options supplier) not too long ago signed a Memorandum of Understanding (MoU) with Solarvest Holdings Bhd (a photo voltaic power firm providing a variety of unpolluted power options).

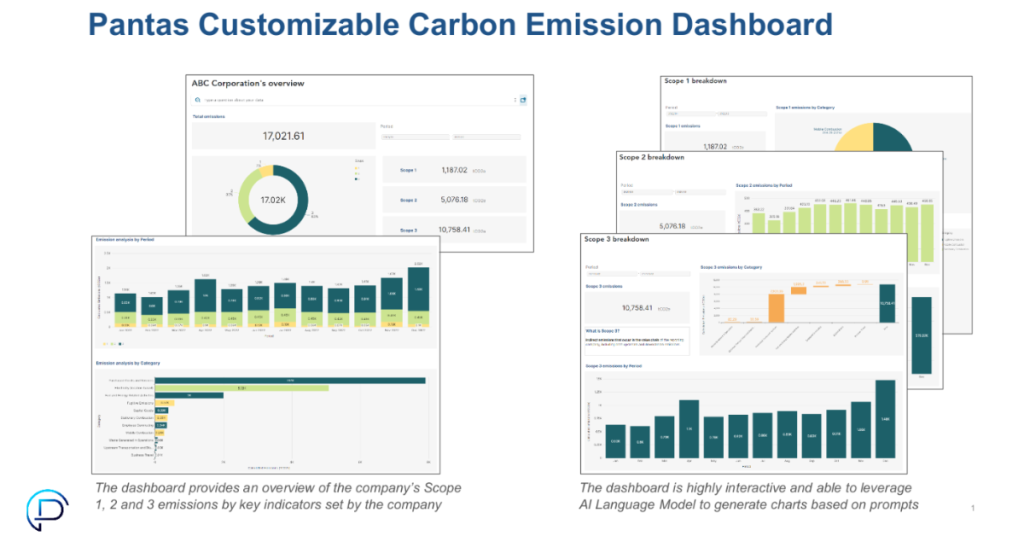

Particularly, the MoU is to combine Solarvest’s clear power options into Pantas’ AI-powered carbon administration and ESG platform, which goals to measure, scale back, and report clients’ carbon footprint, and subsequently provide tailor-made decarbonisation options.

Collectively, they goal to co-develop a key sensible metrics system for decarbonisation suggestions.

Elaborating on this, Pantas’ CEO and co-founder, Max Lee, stated that the sensible metrics system makes use of insights from partners like Solarvest whereas leveraging AI to analyse knowledge from shoppers. It generates tailor-made decarbonisation methods, together with renewable power, waste, and fleet administration options.

He added, “The system estimates prices, ROI, and payback durations for photo voltaic options primarily based on present market costs for photo voltaic panels and electrical energy tariffs. This allows our shoppers to make financially savvy choices about photo voltaic power adoption.”

The brand new collaboration, which was sealed on February 15, 2024, might be executed underneath the Financial institution Negara Malaysia’s Greening Worth Chain (GVS) programme. For context, the programme is meant to assist SMEs start their journey in sustainability reporting.

As a part of this MoU, Solarvest serves because the decarbonisation accomplice that can incentivise and help native companies to take the primary steps in the direction of sustainable operations.

However, Pantas serves because the digital accomplice and advocates for clear power options that align with their actionable knowledge insights.

Collectively, the 2 corporations present an end-to-end decarbonisation journey aimed to streamline and accelerate the adoption of renewable power.

Companies can leverage this newest providing from Pantas and Solarvest by accessing up to RM10 million in financing via BNM’s Low Carbon Transition Facility (LCTF), at a most financing charge of 5% every year.

Pivoting in the direction of sustainability options

A few of you may keep in mind this, however Pantas used to be in a unique area earlier than June 2022. The corporate was centered on e-invoicing and financing for SMEs earlier than pivoting to turn out to be a carbon administration and ESG platform.

Confiding in us, CEO Max Lee shared that their preliminary focus didn’t obtain the anticipated market penetration.

On the identical time, they recognized a big but unmet demand in Southeast Asia for automated options in carbon administration and ESG reporting.

“Our market evaluation revealed a robust urge for food amongst companies for such providers, evidenced by their willingness to rapidly commit to contracts of a 12 months or longer,” he stated.

In Malaysia notably, they discovered that corporations confronted vital challenges with ESG reporting, particularly in managing and reporting carbon emissions precisely.

Pantas comes in by providing providers to streamline the reporting course of, making it simpler to handle and fewer resource-intensive for companies.

By way of this, the corporate assists shoppers in assembly stringent regulatory calls for and facilitates a smoother transition in the direction of sustainability.

Additional growing the native ESG panorama

Being a part of the trade, Max shared that Malaysia’s ESG framework is regularly growing. The emphasis at present is on integrating ESG ideas into varied sectors.

Though nonetheless in its early levels, there’s noticeable momentum pushed by regulatory initiatives and rising market curiosity.

To additional improve ESG adoption, he really useful three areas that we want to deal with:

- Growing training and consciousness on the significance of ESG

- Introducing monetary incentives like tax reductions for ESG-compliant corporations

- Adopting standardised ESG reporting tips that’s comparable to Bursa Malaysia’s Sustainability Reporting Information for listed corporations

That stated, since pivoting in June 2022, Max reported that Pantas has acquired a rising curiosity and inquiries from shoppers. This displays a constructive development in the direction of ESG integration in Malaysia.

Thus far, their clientele consists of notable organisations like AmBank Group, SP Setia, Pos Malaysia, and Kasikorn Financial institution which is considered one of Thailand’s largest banks.

“For continued progress, it’s essential for all stakeholders, together with the federal government, companies, and NGOs, to collaborate in selling ESG practices. Such efforts can accelerate Malaysia’s journey in the direction of sustainability and align it nearer to world ESG requirements,” he concluded.

- Study extra about Pantas Software program Sdn Bhd right here.

- Study extra about Solarvest Holdings Bhd right here.

- Learn different articles we’ve written about Malaysian startups right here.

Featured Picture Credit score: Pantas Software program Sdn Bhd