Forbes launched its inaugural “Malaysia’s 50 Richest” listing on April 16, revealing that the mixed wealth of the nation’s 50 richest was up by a modest 2% this 12 months.

Most are acquainted faces, however 4 newbies have joined the listing this 12 months. There are additionally some lacking names which had made the minimize final 12 months.

Acquainted faces

Some acquainted faces didn’t budge in any respect from their positions on the earlier 12 months’s Forbes Malaysia’s 50 Richest listing.

100-year-old enterprise tycoon Robert Kuok continues to rank No.1 on the listing with a internet price of US$11.5 billion.

Kuok, one of many world’s oldest billionaires, based the Kuok Group 75 years in the past in Johor Bahru as a modest enterprise buying and selling sugar, rice, and wheat flour, and constructed it right into a thriving conglomerate.

He’s additionally greatest identified for founding the Shangri-La Accommodations and Resorts chain in 1971.

Remaining at No.2 with US$8.Eight billion is Quek Leng Chan, govt chairman of Hong Leong Group, who retained his rating regardless of a dip in his internet price from US$10.2 billion final 12 months.

He inherited a part of his fortune from his father, one among three brothers who began a banking group within the 1920s.

Who popped off

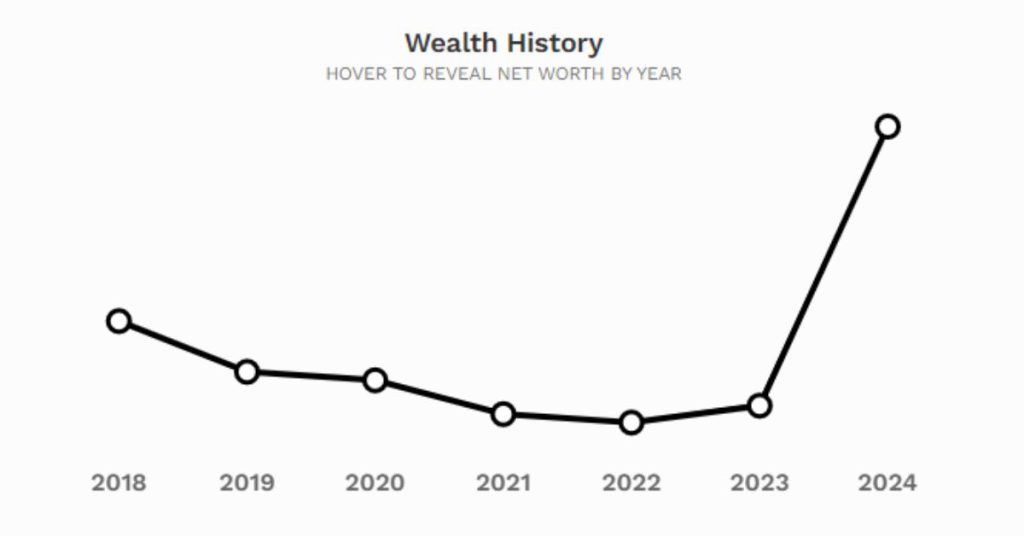

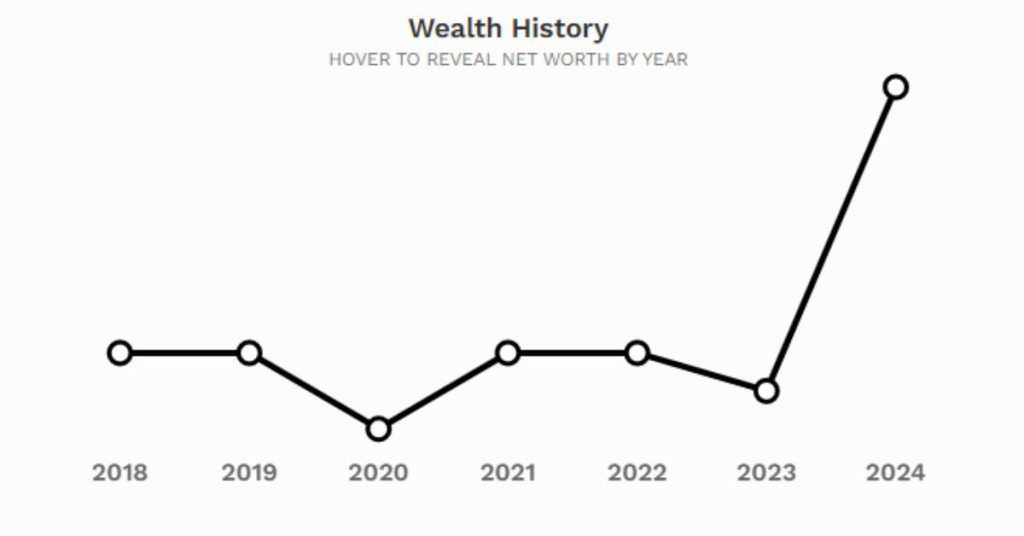

In accordance with Forbes, Francis Yeoh and his siblings noticed the most important enhance of their private fortunes among the many 22 fortunes that had been up this 12 months.

They greater than tripled their mixed fortune to US$4.7 billion and jumped seven spots on the listing to No.7.

Shares of their flagship YTL Corp Bhd, which partnered with US tech large Nvidia to construct AI infrastructure at its information centre park in Johor, have been on a roll.

One other notable gainer is property magnate Jeffrey Cheah, whose Sunway Group is betting on healthcare for future development.

Cheah greater than doubled his wealth to US$2.Four billion to enter the highest 10 for the primary time, sitting at No.8.

Different fortunes within the prime 5 noticed a reshuffle with the Teh siblings.

In banking, the heirs of the late Teh Hong Piow of Public Financial institution fame noticed a slight achieve of their mixed wealth to US$5.Four billion from US$5.three billion within the earlier 12 months. This places them at No.three within the listing.

The Teh siblings overtook Press Metallic Aluminium’s Koon Poh Keongand his siblings, who had been bumped to No.5 with a internet price of US$5.3billion, down from US$5.8billion in 2023, amid weaker demand and costs for the metallic.

Within the property sector, IOI Group’s brothers Lee Yeow Chor and Lee Yeow Seng rose to fourth place on the listing with US$5.35 billion from US$4.6 billion in 2023. That is the primary time they made it into the highest 5.

Beneath the management of youthful sibling Yeow Seng, IOI Properties has quietly constructed up its Singapore portfolio, Forbes shared. It’s now making ready to open a multibillion-dollar workplace complicated within the metropolis’s central enterprise district.

There are additionally 4 newcomers on this 12 months’s listing, amongst them are two units of heirs.

The Chen household got here in at No.18 with US$1.1 billion after inheriting the wealth of on line casino tycoon Chen Lip Keong, who handed away in December.

The late Chen based NagaWorld, which holds a on line casino licence within the Cambodian capital Phnom Penh working to 2065, with a assured monopoly till 2035.

The opposite newcomer coming in at No.12 with US$1.6 billion is the inheritor of the Gnanalingam household, following the loss of life of ports magnate G. Gnanalingam final July.

The Gnanalingam household will get the majority of their wealth from a stake in Westports Holdings, one among three foremost port operators within the Strait of Malacca.

Lim Siow Jin, founder and govt chairman of DXN Holdings, a maker of conventional medicines and natural merchandise that he arrange in 1995 in Malaysia, can also be one other new face within the listing.

DXN manufactures its merchandise in 10 factories throughout Malaysia, China, India, Indonesia, and Mexico.

Lim listed DXN in 2003 however took it non-public in 2011. In 2023, he relisted the corporate on Bursa Malaysia.

Co-founder of the NationGate Holdings, Ooi Eng Leong, is the ultimate newcomer on this 12 months’s listing.

NationGate Holdings raised US$35 million from an IPO in 2023.

Dropped off

The minimal internet price to qualify for the listing was US$320 million, up from US$315 million in 2023.

Three names from final 12 months didn’t meet the cutoff, together with property developer Yu Kuan Chon as shares of his YNH Property plummeted amid monetary issues.

One other lacking identify is Kong Choon Quickly, who’s the co-founder and managing director of United Abroad Australia (UOA).

He co-founded the corporate in 1971 and spearheaded its speedy development in Malaysia and Vietnam by means of creating and working residential and industrial properties. UOA additionally operates accommodations and eating places.

The final individual not making it to Forbes Malaysia’s 50 richest 2024 listing is Steven Siaw Kok Tong who co-founded the electronics firm ViTrox in 2000 along with his former colleague at HP Malaysia.

ViTrox manufactures automated imaginative and prescient inspection tools for the semiconductor and digital packaging industries. Its internet revenue was up 18% and income rose to 10% in 2022 regardless of challenges within the international semiconductor business.

- Learn the entire listing of Malaysia’s 50 Richest by Forbes right here.

- Learn different articles we’ve written about billionaires right here.

Featured Picture Credit score: Kuok Group, Sunway Group, and YTL Company / Robert Kuok, Jeffrey Cheah, and Francis Yeoh