Disclaimer: Any opinions expressed beneath belong solely to the creator. No info printed beneath ought to be handled as monetary recommendation.

Regardless of rising competitors in the e-commerce section, Sea Ltd. has managed to realize its first worthwhile yr since going public in 2017. A reasonably modest US$162 million in web revenue final yr in contrast favourably towards the lack of US$1.7 billion in 2022.

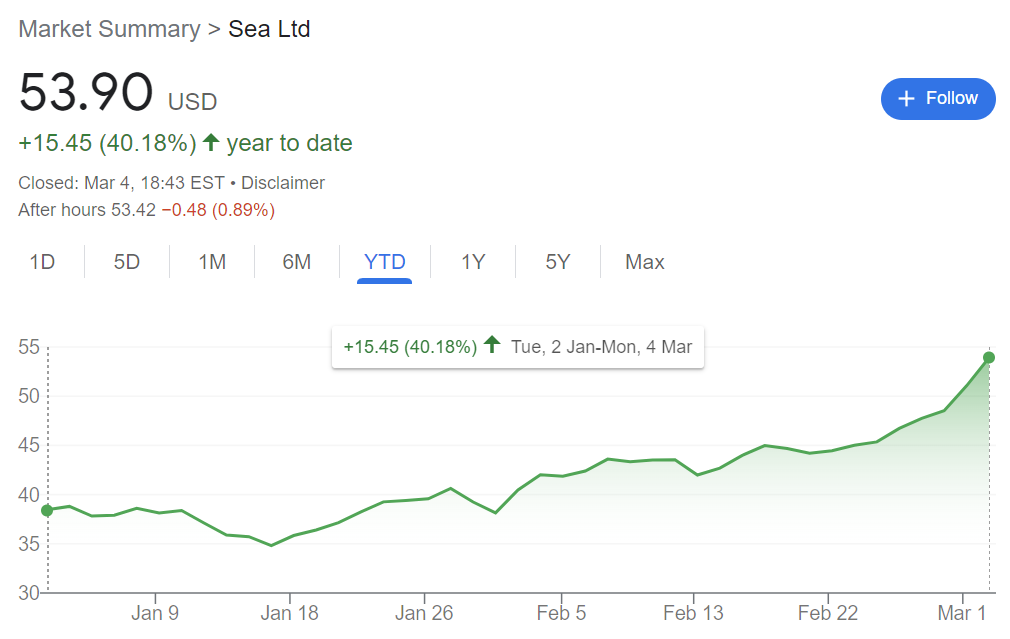

The inventory market reacted positively, leaping as a lot as 11 per cent throughout yesterday’s session, earlier than closing the day at 5.6 per cent, as some traders cashed their positive aspects out.

This bump has pushed the year-to-date rally for Sea Ltd. inventory past 40 per cent over simply 2 months, reflecting a return of optimism about its future.

Shopee fends off rivals

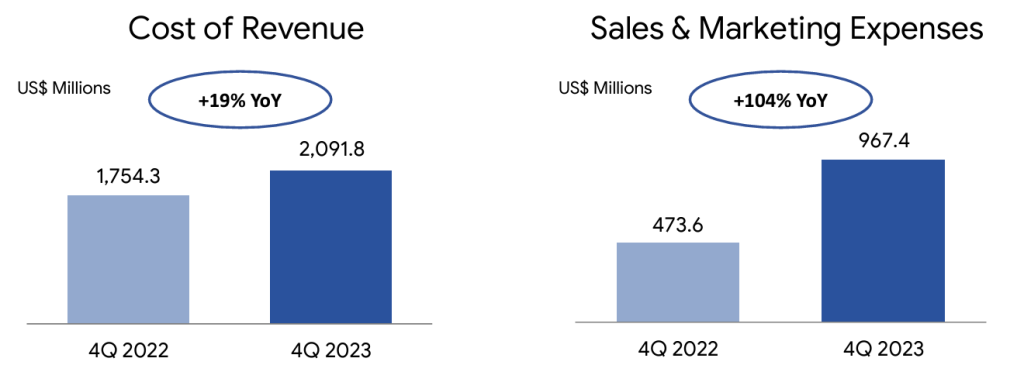

Apparently, the constructive outcome was achieved regardless of a reversal of cost-cutting coverage, which noticed gross sales & advertising bills plummet in late 2022.

Within the 4th quarter of 2023 the corporate spent greater than twice on promotional actions than it did the yr earlier than, approaching US$1 billion, pushed primarily by the response to competitors from Chinese language corporations like Temu.

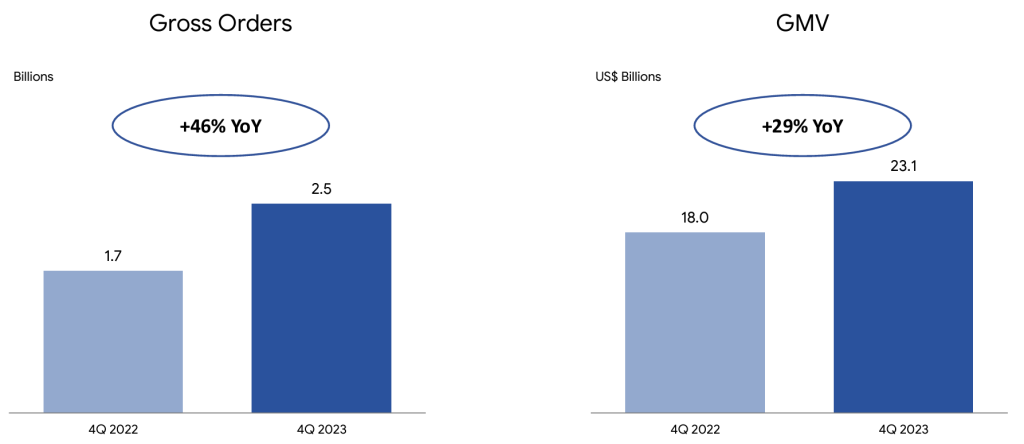

This has helped to spice up quarterly orders by 46 per cent and the Gross Merchandise Worth by over US$5 billion in comparison with the This autumn of 2022.

Due to sturdy quarterly efficiency Shopee managed keep away from statistical stagnation for the complete 2023, as with out the extra 800 million orders in This autumn it might have struggled to indicate annual development.

That is more likely to develop into a recurring theme for Sea for the foreseeable future, because it tries to stability the necessity to spend sufficient to drive purchases and staying worthwhile in a time of restricted entry to low-cost capital.

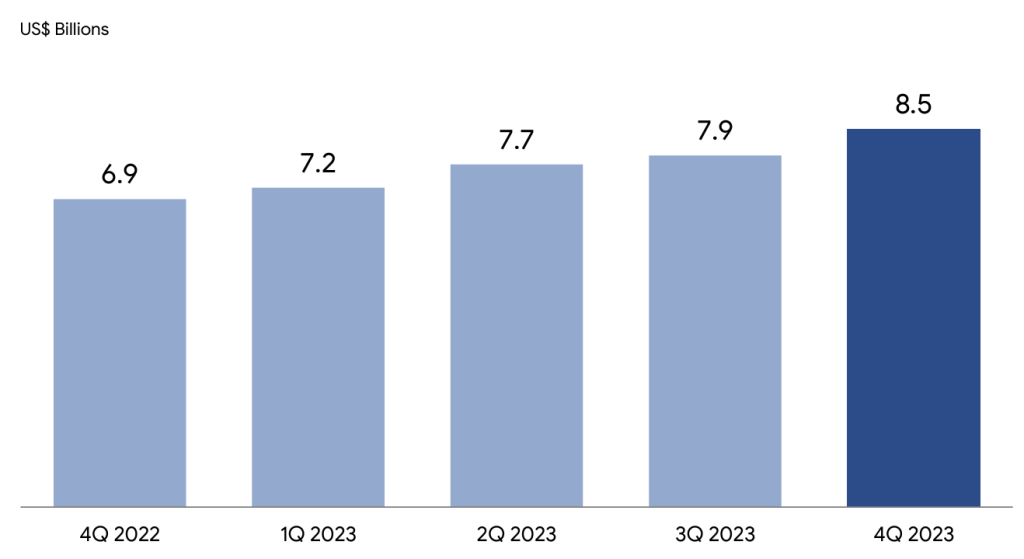

On this context, maybe one of the best information to come back out of the corporate is that it has managed to develop its money reserves by one other US$1.6 billion this yr, exhibiting that liquidity shouldn’t be an issue (though it nonetheless can’t spend almost as a lot because it did earlier than the onset of world inflation in 2022).

Garena shrinks in half…

All the above is especially excellent news on condition that Sea’s money cow, the digital leisure arm Garena, has suffered a hunch in the post-pandemic world, the place individuals are not caught at residence enjoying video video games.

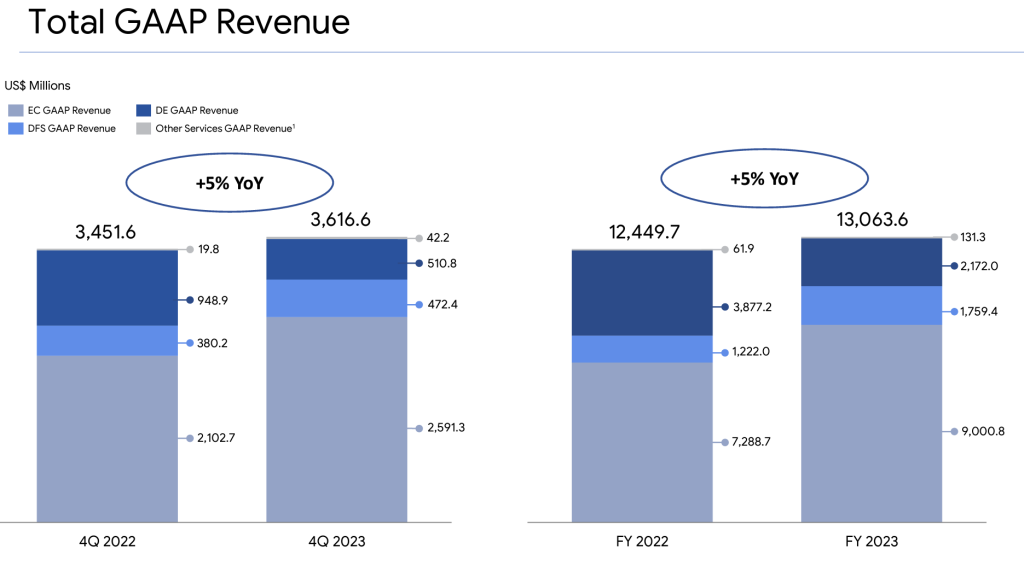

Income in the section fell by over 46 per cent, from US$948 million to simply US$510 million for the final quarter, and by 44 per cent, from US$3.87 to simply US$2.1 billion for the complete yr.

All of those figures are beneath 50 per cent of what the corporate pulled in from gaming in 2021, when annual income topped US$4.Three billion, on the peak of COVID-19 lockdowns.

…however SeaMoney fills the hole

Sea Ltd. is in a continuing state of flux between its three constituent companies. When one struggles others choose up.

It began with gaming, which developed into e-commerce — that now supplies the majority of the income and is probably going seen by traders as essentially the most worthwhile half — and digital finance, rising at a good tempo, having offered US$1.eight billion in income, a rise of 44 per cent over 2022.

Which means that even because the composition of Sea’s income flows adjustments, the overall determine retains climbing.

In 2022 Garena introduced in 3 times as a lot cash as SeaMoney did, however a mere yr later they have been nearly neck and neck.

If the development continues (as it’d given the stagnation in cellular gaming) the enterprise that Sea was based on stands out as the smallest of all by the top of 2024.

However, Sea is seen primarily as an ecommerce firm and the fortunes of Shopee are more likely to dictate the way it fares in the subsequent few years, earlier than digital banking can set up itself as a potent cash maker. By then, digital leisure would possibly develop into a facet observe in its books.